Corporate Governance Structure

- Corporate Governance Structure

- Basic Internal Control Policy

- Compliance

- Risk Management

- Disclosure Policy and IR Policy

Corporate Governance System

The Company conducts a diverse range of business globally. Accordingly, the Company has established a corporate audit governance model of a Company with auditors in which the Board of Directors consisting of Internal Directors and Outside Directors has been established in order to ensure rapid and efficient decision-making and appropriate supervisory functions in management. The Company has determined that this governance model is functioning effectively as set forth in items (a) and (b) below. Therefore, the Company will retain the current governance structure.

(a) Ensuring rapid and efficient decision-making

The Company ensures rapid and efficient decision-making by appointing Directors who serve concurrently as Executive Officers and are well-versed in the Company’s diverse business activities.

(b) Appropriate supervisory functions

The Company ensures appropriate aim for development that is in harmony supervisory functions by implementing various measures, including appointing Outside Directors that account for the majority of candidates for the Board of Directors; establishing the Audit & Supervisory Board Member’s Office; fostering collaboration among the Audit & Supervisory Board Members, the Audit Department and the Accounting Auditor; and carrying out advance briefings, on the same occasion, on matters referred to the Board of Directors for both Outside Directors and Outside Audit & Supervisory Board Members.

Zoom

Board of Directors

The Board of Directors comprises 10 Directors (including six Outside Directors; eight males and two female. The percentage of female director on the Board is 20%), and makes decisions regarding management policy and other important matters and supervises the execution of duties by Directors.

To clearly segregate management and execution, the Chairman of the Board without representative rights and the authority for business execution, in principle, chairs the Board of Directors Meetings.

In FY2022, the Board of Directors met 16 times to make decisions regarding execution of duties by the Corporation and all members of the Board of Directors were present at all meetings during their terms of office, excluding Mr. Kikuchi, who was absent for 1 meeting. In FY2022, the Board of Directors mainly deliberated as below:

——政策来提高公司治理体制m (revision of criteria for submission to the Board of Directors, improvement of organizational capability in business investments, etc.)

- Investment and financing projects (establishment of a wholly-owned subsidiary through a corporate spinoff in ICT field, etc.)

- Financial results and other finance related matters (share repurchases, etc.), remuneration for Directors/Audit & Supervisory Board Members

- Evaluation of the effectiveness of the Board of Directors, internal control related matters, etc.

The term of Board of Directors is one year to clarify management responsibility and flexibly build optimum management structure in response to changing management environment.

Audit & Supervisory Board

The Audit & Supervisory Board comprises five Audit & Supervisory Board Members (including three Outside Audit & Supervisory Board Members), and Mr. Toshiaki Kida, a Full-time Audit & Supervisory Board Member, serves as the chair. The Company adopts a corporate audit governance system and each of the Audit & Supervisory Board Members is responsible for overseeing Directors in the execution of their duties by attending important meetings, such as the Board of Directors Meetings, and by monitoring business activities and financial conditions in accordance with the auditing policies and plans set by the Audit & Supervisory Board.

审计和监事会成员和亚柯unting Auditor exchange information and their opinions concerning, for instance, audit plans, audit status and results of the Corporation and each of its group companies (including quarterly review), each audit matter (including selection of key audit matters), important aspects of the financial results, and trends on accounting audits, etc. at monthly meetings. The Company's Accounting Auditor for FY2022 was Ernst & Young ShinNihon LLC. The Audit & Supervisory Board Members and the Audit Department, a department which performs internal audits, exchange opinions at regular meetings (9 times a year) and implement audit operations through close cooperation. In FY2022, the Audit & Supervisory Board met 17 times, and all Audit & Supervisory Board Members were present at all meetings of the Audit & Supervisory Board during their terms of office, excluding Mr. Kikuchi, who was absent for 1 meeting.

The President holds meetings with the Audit & Supervisory Board Members on a regular basis, reports on execution of duties, and exchange opinions. Other Directors, Group CEOs, the CDIO, Division COOs and Corporate Staff Group General Managers report their duty execution status to the Audit & Supervisory Board Members every year. Officers immediately report to the Audit & Supervisory Board Members when they discover that there is a concern that the Company will suffer significant damage.

Corporate Management Committee

企业管理委员会是一个顾问committee for the President and consists of three Representative Directors including the President, three Senior Managing Executive Officers, three Managing Executive Officers, and one Executive Officer. It deliberates management-related policies and important company-wide matters.

Committee of Chief Operating Officers

t的成员he Committee of Chief Operating Officers are the President, alongside Executive Officers and Chief Operating Officers appointed by the President.

They discuss matters pertaining to budgeting, account settlement and financial planning as well as other issues related to the execution of business.

Committee of Executive Officers

The Committee of Executive Officers consists of 40 Executive Officers (three of whom also serve as Director) and communicates management information and gives reports on matters that affect business execution such as financial performance and results of internal audits.

Nomination Committee

The memberships of the committee are composed so as to ensure independence, as Independent Outside Directors/Audit & Supervisory Board Members constitute the majority of the members and the committee is chaired by an Independent Outside Director as well. The Nomination Committee mainly deliberates on proposals regarding the selection of candidates of Director and Audit & Supervisory Board Member, proposals regarding the selection of the President for the next term, and successor plans formulated and operated by the President (including plans related to necessary qualities and requirements, successor candidate groups, and training), and reports to the Board of Directors. In FY2022, six Committee meetings were held for deliberations regarding candidates of Director and Audit & Supervisory Board Member and succession plans etc., and all the Committee members attended all the meetings.

Committee’s Members: Inside Director 1, Outside Directors 2

Chairperson: Outside Director

Governance and Remuneration Committee

The memberships of the committee are composed so as to ensure independence, as Independent Outside Directors/Audit & Supervisory Board Members constitute the majority of the members and the committee is chaired by an Independent Outside Director as well. The Governance and Remuneration Committee deliberates on the policy for determining remuneration for Directors and Executive Officers as well as appropriateness of the level of remuneration, and reports to the Board of Directors. Furthermore, it deliberates on important matters related to corporate governance and conducts assessments and reviews of the Board of Directors as a whole, including on its structure, operation, etc., and reports thereon to the Board of Directors. In FY2022, seven Committee meetings were held for deliberations regarding remuneration for Directors and Executive Officers, review of compensation plans, evaluation of the effectiveness of the Board of Directors, and disclosure of information on Directors/Audit & Supervisory Board Members. All Committee members attended all of the meetings.

Committee’s Members: Inside Directors 2, Outside Directors 2, Outside Audit & Supervisory Board Members 1

Chairperson: Outside Director

Overview of Corporate Governance Systems

| Organization Form | Company with auditors |

|---|---|

| Chairperson of the Board | Chairperson |

| Number of Directors | 10 (including 6 Outside Directors) |

| Number of Audit & Supervisory Board Members | 5 (including 3 Outside Members of Audit & Supervisory Board) |

All Outside Directors and Audit & Supervisory Board Members are independent officers as defined by the Tokyo Stock Exchange.

Number of Times convened in FY2021 : Major Board and Committee Meetings

| Board of Directors | 16 times |

|---|---|

| Audit & Supervisory Board | 17 times |

| Corporate Management Committee | 31 times |

| Committee of Chief Operating Officers | 3 times |

| Committee of Executive Officers | 3 times |

Committees

The Company has established various committees as an organization directly under the President for dealing with important matters related to business execution and internal control, etc.

The main committees and their roles are as follows:

| Committee | Role | Chairman | Meeting Frequency |

|---|---|---|---|

| Investment and Credit Committee |

The committee discusses projects subject to the internal approval (“Ringi”) system. The Chairman of the Investment and Credit Committee makes decisions on proposals to be submitted to the Corporate Management Committee. | Senior Managing Executive Officer, Member of the Board (Takayuki Furuya) |

In principle, weekly |

| Compliance Committee | The committee provides enlightenment activities such as training as well as establishment, maintenance and management of the compliance system of the Marubeni Group. | Senior Managing Executive Officer (Mutsumi Ishizuki) |

In principle, 4 times a year, and as needed |

| Sustainability Management Committee | The committee deals with the identification and periodic review of “Materiality” which takes into account the ESG (environmental value, social value and governance) point of view as it pertains to business fields as a whole and also deliberates matters related to sustainability, including ESG support, and reports on this to the Board of Directors. | Senior Managing Executive Officer, Member of the Board (Takayuki Furuya) |

In principle, once a year, and as needed |

| Internal Control Committee | The committee confirms and reviews status of formulation and operation of basic internal control policy in accordance with the Companies Act, drafts their revision proposals, develops and operates system and evaluates effectiveness regarding financial reporting in accordance with the Financial Instruments and Exchange Act and prepares internal control report drafts. | Senior Managing Executive Officer (Mutsumi Ishizuki) |

As needed |

| Disclosure Committee | The committee formulates principles and basic policy drafts regarding disclosure, establishes and improves the internal system regarding statutory disclosure and timely disclosure, and judges significance and appropriateness regarding statutory disclosure and timely disclosure. | Senior Managing Executive Officer, Member of the Board (Takayuki Furuya) |

As needed |

Roles and Functions of Outside Directors and Outside Audit & Supervisory Board Members

Roles and Functions of Outside Directors

Outside Directors offer opinions on business management drawn from their broad experience and high-level perspective, and give advice to better implement corporate governance.

外部董事出席董事会会议of Directors and the Committee of Executive Officers, making active contributions from the perspective of internal control. Prior to meetings, Outside Directors are provided with agendas and fully briefed on management issues and project execution status. Two of the Outside Directors are members of the Governance and Remuneration Committee (one is the chairman) and three are members of the Nomination Committee (one is the chairman).

*Please refer to [the Corporate Governance Report]for Reasons of Appointment.

Roles and Functions of Outside Audit & Supervisory Board Members

Outside Audit & Supervisory Board Members monitor the Directors' execution of duties and draw upon their wealth of professional expertise to offer various recommendations and advice to enhance the Audit & Supervisory Board.

Outside Audit & Supervisory Board Members attend meetings of the Audit & Supervisory Board and also the Board of Directors and Committee of Executive Officers. In addition, the Outside Audit & Supervisory Board Members meet with the President on a regular basis, as well as with members of the Audit Department, Corporate Accounting Department, and outside auditors, for an exchange of opinions. They receive audit-related information from Full-time Audit & Supervisory Board Member, which they use in the execution of their auditing duties. One of the Outside Audit & Supervisory Board Members is also a member of the Governance and Remuneration Committee.

*Please refer to [the Corporate Governance Report]for Reasons of Appointment.

Executive Compensation

The policy to determine the remuneration and other payments for Directors are as follows.

1.Remuneration policy

The remuneration for Directors of the Corporation is determined based on the following policy.

(1) The remuneration plan shall encourage Directors to face issues of society and customers and create new value with all stakeholders in accordance with the spirit grounded in the Company Creed of “Fairness, Innovation and Harmony” and reward them.

(2) The remuneration plan shall place emphasis on the linkage with business results and shareholder value and encourage the enhancement of corporate value over the medium to long term.

(3) The remuneration plan shall acquire, maintain and reward excellent human capital, the critical source of corporate value.

(4) The remuneration plan shall be a fair and just system by which decisions are made based on a highly transparent process according to responsibilities and performance.

2.Remuneration framework

The target persons of each type of remuneration and other payments are determined by his/her expected role. Please refer to the table below for details.

| Type | Form of Payment | Description | Executive Director | Chairman of the Board (Note 1) |

Outside Director (Note2) |

||

|---|---|---|---|---|---|---|---|

| Monthly remuneration | Basic compensation | Fixed | Monetary | ○Fixed consumption corresponding to each Director’s position | ● | ● | ● |

| Bonuses | ○Directors who have representative authority are paid representative director bonuses for their responsibilities ○Directores are paid director bonuses for their responsibilities |

● | - | - | |||

| Short-term incentive remuneration (Note 4) |

Performance-based bonuses | Variable | ○Remuneration and other payments for business performance of each business year - The evaluation indicators shall be consolidated net profit (profit attributable to owners of the parent) and core operating cash flow, which are important KPIs. - The amount of payment is calculated using the actual values of the coefficient by position and the evaluation indicators, and it fluctuates within the range between 0% and 230% of the basic compensation by position. - Business performance ranges are set between 170 billion yen and 700 billion yen for consolidated net profit and between 270 billion yen and 800 billion yen for core operating cash flow. |

● | - | - | |

| Individuals’ evaluation-based compensation | [Organization’s performance evaluation] ○Remuneration and other payments according to the achievement of financial targets by headquarters for each business year - The evaluation indicators shall be net profit and core operating cash flow of each business division. - The amount of payment is derived by multiplying the ratio to reflect the evaluation determined by the Board of Directors based on the rate of achievement of evaluation indicators against the basic compensation by position. |

- (Note3) |

- | - | |||

| [Individuals’ qualitative evaluation] ○Remuneration and other payments for new value creation looking toward the future - As commissioned by the Board of Directors, the President shall evaluate each Director’s performance considering his/her contribution to the plans and efforts (sustainability measures including "Green Strategy," etc.) to create new value for the future of the Corporation during the fiscal year. - The amount of payment is derived by multiplying the ratio to reflect evaluation within the range determined by the Board of Directors against the basic compensation. - The Governance and Remuneration Committee checks whether the evaluation is appropriately conducted within the scope delegated by the Board of Directors and provides reports to the Board of Directors. |

● | - | - | ||||

| Medium and long-term incentive remuneration | Restricted Stock | Shares | ○Remuneration and other payments to promote linkage and sharing with shareholder value - The Corporation’s common stock of the number suitable to the standard amount determined for each position is allotted every year with restriction on transfer for the period from the date of stock allotment until the retirement from a position of Director and Executive Officer or other positions predefined by the Board of Directors of the Corporation or the resignation from the Corporation. |

● | ● | - | |

| TSR-linked Performance Share Units | ○Remuneration and other payments for enhancing corporate value over the medium to long term - Relative TSR is used as the evaluation indicator. Relative TSR is calculated using the following formula by which the Corporation’s Total Shareholder Return (TSR) for a period of three years (evaluation period) is compared with the TOPIX Dividend growth rate for the same period. Relative TSR = the Corporation’s TSR for the evaluation period / TOPIX Dividend growth rate - The number of standard units corresponding to the base amount determined by position is allotted every year, and the Corporation’s common stock is allotted according to the magnitude of achievement of relative TSR during the three-year evaluation period. Restriction on transfer is set on the allotted Corporation’s common stock from the date of share issuance to the time of retirement from a position of the Corporation’s Director, Executive Officer or other position predetermined by the Corporation’s Board of Directors, or resignation from the Corporation. - The number of allotted shares fluctuates within the range between 0% and 150% of the number of shares corresponding to the standard unit according to the magnitude of achievement of relative TSR. 1) If relative TSR is 150% or above: 150% 2) If relative TSR is 50% or above and below 150%: Same percentage as relative TSR 3) If relative TSR is below 50%: 0% Note, however, that if the Corporation's TSR is 100% or below, the maximum shall be 100% even when the relative TSR is 100% or above. |

● | ● | - | |||

Note 1. Remuneration and other payments for the Chairman of the Board consist of the monthly remuneration as the basic compensation and the medium- and long-term incentive remuneration, considering that the Chairman of the Board is in the position to substantially contribute to the enhancement of corporate over the medium to long term through leveraging the business expertise gained through managing the Corporation on supervision.

Note 2. Remuneration and other payments for Outside Directors consist entirely of the monthly remuneration as the basic compensation (including remuneration for responsibilities as the chairperson, member, etc., of each respective committee), considering that Outside Directors are in the position to supervise management with independence.

Note 3. The Executive Officer & Chief Operating Officer of business division is eligible to receive the individuals’ evaluation-based compensation based on the organization’s performance evaluation, and currently there is no Executive Director eligible for the payment.

Note 4. Short-term incentive remuneration will be paid in a lump sum at the end of each fiscal year.

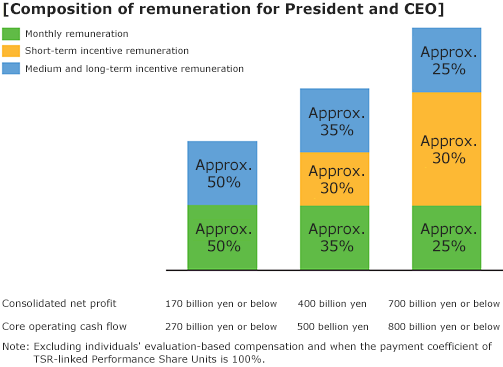

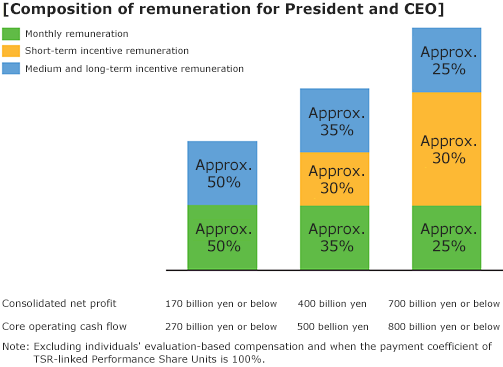

3.Remuneration levels and composition ratio

To ensure that remuneration levels of Directors are competitive so as to secure and maintain excellent human capital, the remuneration levels are examined by comparing them with objective research data on remuneration provided by outside specialized organizations and other sources to determine the appropriate remuneration levels. As for the composition ratio of remuneration and other payments, it shall focus on the medium- and long-term improvement of corporate value by increasing the composition ratio of the medium- and long-term incentive remuneration. For the President & CEO, its composition ratio of monthly remuneration/the short-term incentive remuneration/the medium- and long-term incentive remuneration shall be set as 1:1:1 when consolidated net profit is 400 billion yen and core operating cash flow is 500 billion yen. For other internal Directors, based on the remuneration composition ratio of the President and CEO, the Corporation shall set up the ratio considering the role and responsibilities of each position.

ZOOM

4.Malus and Clawback

The short-term and the medium- and long-term incentive remuneration shall be the subject of the clauses that allow the Corporation to reduce or cancel the remuneration (Malus) and request the return of the paid remuneration (Clawback) based on the resolution of the Board of Directors when there was an adjustment of financial results after an announcement due to a significant revision of financial statements or there was a significant violation or breach of internal rules by an officer.

5.Method to determine the remuneration and other payments for individual Directors

As for the policy to determine the remuneration and other payments for Directors (including the method to determine individual payments. Hereinafter referred to as the “Determination Policy”), the Governance and Remuneration Committee chaired by an Outside Director with the majority of its members consisting of independent Outside Directors/Audit & Supervisory Board Members deliberates on the Determination Policy, including the appropriateness of the remuneration levels, and provides reports to the Board of Directors for its determination of the Policy.

As for the determination of individual payments for Directors, the Governance and Remuneration Committee confirms the conformity to the Determination Policy and provides reports. Within the range of the maximum amount of remuneration resolved at a General Meeting of Shareholders, the payments are resolved at a meeting of the Board of Directors. However, as for the individual evaluation remuneration of the short-term incentive, the determination of payment for individual quantitative evaluation is commissioned to the President because it is judged that the person at the head of business execution is the most appropriate person. To improve the objectiveness, fairness and transparency, as for the amounts to be paid, the Governance and Remuneration Committee shall confirm that the evaluation has been conducted within the scope commissioned by the Board of Directors, and report them to the Board of Directors.

(Supplementary matter)

The process regarding remuneration for Executive Officers who do not concurrently serve as Director will be revised to the same remuneration framework and determination process as those for Directors.

The total amount of remuneration and other payments for Directors and that for Audit & Supervisory

最大的报酬总额等payments for Directors and that for Audit & Supervisory Board Members are determined as follows by the resolutions at the 99th Ordinary General Meeting of Shareholders.

| Category | Types of Remuneration | Resolution | Number of Directors/ 审计和监事会成员at the time of close of the respective Ordinary General Meeting of Shareholders |

|---|---|---|---|

| Directors | Monthly remuneration | Within 650 million yen per year (including within 150 million yen per year for Outside Directors) Eligible persons: Directors (including Outside Directors) | 10 Directors including (including 6 Outside Directors) |

| Short-term incentive remuneration | Within 700 million yen per year Eligible persons: Directors (excluding Outside Directors and the Chairman of the Board) | 3 Directors(including 0 Outside Directors) | |

| Restricted Stock | The total amount of monetary remuneration claims for granting Restricted Stock shall not exceed 200 million yen per year (the maximum number of shares to be issued or disposed of shall not exceed 450,000 shares per year (Note 1)).(Note 2) Eligible persons: Directors (excluding Outside Directors) | 4 Directors(including 0 Outside Directors) | |

| TSR-linked Performance Share Units | The total amount of monetary remuneration claims for granting TSR-linked Performance Share Units shall not exceed 850 million yen per year (the maximum number of shares to be issued or disposed of shall not exceed 650,000 shares in each valuation period* | ||

| Audit & Supervisory | Total amount of remuneration and other payments | Within 170 million yen per year | 5 Audit & Supervisory Board Members |

* If any event arises that requires an adjustment of the total number of shares of common stock of the Corporation to be issued or disposed of, such as a stock split, gratis allotment, or consolidation of shares of common stock of the Corporation, such total number shall be adjusted to the extent reasonable.

Total amount of remuneration and other payments for directors and that for Audit & Supervisory in FY2022

| Category | Number of Recipient | Total amount of payment (Millions of yen) | Breakdown (Millions of yen) | |||||

|---|---|---|---|---|---|---|---|---|

| Basic compensation* | Performance based compensation* | Restricted Stock | Market Capitalization linked Performance Share Units | [Former plan] Stock compensation-type stock options subject to market capitalization-based exercisability conditions |

||||

| Directors | Internal Directors | 11 | 1,136 | 295 | 529 | 170 | 93 | 50 |

| Outside Directors | 7 | 104 | 104 | - | - | - | - | |

| Total | 18 | 1,240 | 399 | 529 | 170 | 93 | 50 | |

| 审计和监事会成员 | Internal Audit & Supervisory Board Members | 2 | 80 | 80 | - | - | - | - |

| Outside Audit & Supervisory Board Members | 3 | 51 | 51 | - | - | - | - | |

| Total | 5 | 131 | 131 | - | - | - | - | |

*The amounts presented for “basic compensation” and “performance-based compensation” are the total amounts of cash compensation and do not include “Restricted Stock.”

Individuals to whom the total amount of compensation paid exceeded 100 million yen in the FY2022

| Name | Category of Position | Amount of Payment | Breakdown (Millions of yen) | ||||

|---|---|---|---|---|---|---|---|

| Basic Compensation | Performance based Compensation | Restricted Stock | Market Capitalization linked Performance Share Units | [Former plan] Stock compensation-type stock options subject to market capitalization-based exercisability conditions |

|||

| Fumiya Kokubu | Director | 291 | 72 | 142 | 46 | 20 | 11 |

| Masumi Kakinoki | Director | 346 | 87 | 168 | 55 | 24 | 13 |

| Akira Terakawa | Director | 203 | 59 | 98 | 32 | 14 | - |

| Takayuki Furuya | Director | 149 | 43 | 72 | 24 | 10 | - |

Evaluation of the effectiveness of the board of directors

Since FY2016, the Corporation has held evaluations on effectiveness regarding the Board of Directors annually and made efforts to improve it by striving to address issues identified as a result of these evaluations and analyses.

The Board of the Directors is comprised of a majority (60%) of Independent Outside Directors with the aim of strengthening supervisory functions. In this context, an evaluation of effectiveness regarding the Board of Directors was held in FY2022 as an opportunity for discussion on the Board of Directors as a whole on the topic of a “Governance model suitable for the Corporation with regards to current circumstances and characteristics.” This evaluation is intended to increase mid- to long-term corporate value in addition to facilitating a strengthening of supervisory functions.

I. Evaluation framework and methodology

1. Evaluation target

The Board of Directors (including Governance and Remuneration Committee and Nomination Committee)

2. Evaluation process

With the context of the questionnaire responses and interviews by all members of the Board of Directors and Audit & Supervisory Board Members as a basis, the Governance and Remuneration Committee carried out evaluations and reviews regarding results of analyses, and the Board carried out deliberations.

3. Evaluation items

- (1) Roles of the Board

- (2) Structure of the Board

- (3) Discussions at the Board

- (4) Utilization of committees

- (5) Accountability to stakeholders

4. Utilization of outside specialized organization

Utilizing an outside specialized organization, the Board carried out analysis and evaluation based on advanced document inspection as well as responses to questionnaires and interviews.

Ⅱ Overview of evaluations results

1. Overview

Through the process above, it has been confirmed that the Corporation’s Board of the Directors operates appropriately and that its effectiveness is secured.

Thanks in particular to the appropriate management of the proceedings by the chair, the following favorable evaluations were received.

- Elicitation of statements from directors, convergence of opinions, and follow-up on raised issues are managed in a timely and appropriate manner, while the Board is also operated soundly.

- Lively discussions are conducted among the directors, including the Outside Directors.

- Systems and processes for providing appropriate pre-explanations and post-reports on important issues are functioning sufficiently.

2. Handling issues in effectiveness evaluations pertaining to the Board of Directors in FY2021

(1)Enhancement of discussions at Board of Directors meetings regarding key material management issues, changes in external environment, and risks.

Utilizing opportunities other than routine meetings of the Board of Directors, the Directors discussed changes in the external environment, responding to the issues in energy security, international affairs, and other areas. Evaluations on these items have improved compared to results for FY2021, including evaluations in the results of questionnaires and interviews.

Furthermore, in order to strengthen the supervisory functions of the Board of Directors, it delegated authority to the Executive Officers, and agendas submitted to the Board have come to focus on more pressing management issues. As stated in “3” below, the Board will continue to implement further measures for improvement.

(2)Discussions regarding HR strategy and allocation of management resources to human capital

The Board of Directors supervised a progress review of the human resources strategy under the Mid-Term Management Strategy (“GC2024,”) and held discussions on the direction of such strategy, and other areas separate to regular meetings of the Board. As stated in “3” below, the Board will continue to consider its supervisory functions for human capital during investigations into the ideal configurations for deliberations and monitoring on a Group-wide basis.

(3)Supporting the Outside Directors to further utilize their expertise

In addition to the current provision of sufficient education opportunities and information to Outside Directors, the Corporation improved the support for Outside Directors to allow them to fulfill their duties and responsibilities, including the provision of opportunities to discuss and engage with executives.

These items have generally been highly evaluated, including in the results of questionnaires and interviews.

3. Handling issues in effectiveness evaluations pertaining to the Board of Directors in FY2022

(1)Deepen the discussions at the Board regarding the overall direction of the Board to strengthen its supervisory functions

The Corporation believes it is important to deepen discussions related to the overall direction of the Board of Directors and its supervisory functions based on the Group’s future vision and Mid-Term Management Strategy “GC2024” to institute improvements.

建立董事会将继续讨论“Governance model suitable for the Corporation based on current circumstances and characteristics,” including the facilitation of meetings separate to routine meetings of the Board.

(2)Considering the process of selecting the items discussed at the Board and supervisory functions related to the important issue of Marubeni Group management

The Corporation believes it is important to select the items discussed at meetings of the Board of Directors based on its supervisory functions, and that it is necessary to strengthen these functions from the perspective of the entire Marubeni Group regarding important themes in Group management, such as governance and the allocation of management resources to human capital, etc.

The items that will be discussed at the meetings of the Board of Directors should be selected by reflecting on its intentions, including on opinions of the Outside Directors. The Board of Directors will endeavor to monitor themes from the point of view of Group management through reviews of the Mid-Term Management Strategy “GC2024,” etc.

Referring to the results of effectiveness evaluations regarding the Board of Directors, the Corporation will continue to work on maintaining and improving the effectiveness of the Board of Directors going forward and to pursue improvements in long-term corporate value.